Sensex Pe Ratio - The Counterintuitive Truth About Stock Market Valuations Morning Brief / View stocks with a price earning ratio.

Sensex Pe Ratio - The Counterintuitive Truth About Stock Market Valuations Morning Brief / View stocks with a price earning ratio.. The intention here is to. Get live s&p bse sensex quotes. View top bse stocks based on their price earning ratios in top 100 sector. The sensex p/e is the ratio of price of the index to its eps. Gainers, losers, volume toppers in s&p bse sensex stocks.

Get all the current stock/share market news; See the ratios of all the stocks in top 100 sector bse After you have understood the what is pe ratio and how to interpret pe ratio, it's time for us to share the pe ratio of sensex with readers. Get historical data for the s&p bse sensex (^bsesn) on yahoo finance. Therefore, if the pe ratio for sensex stands at 28, investors are willing to pay rs 28 for one.

See the ratios of all the stocks in top 100 sector bse

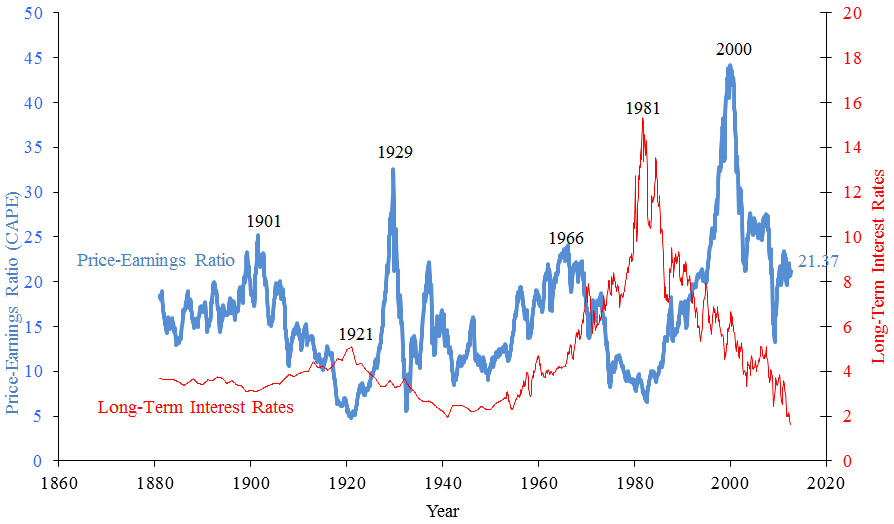

The ratio of total market cap to total net profit is the sensex pe! View top bse stocks based on their price earning ratios in top 100 sector. Compare all indices pe (ttm) other links. If you have ever invested in equities than you might be familiar with the term sensex pe ratio (price earning ratio). Nifty pe ratio, pb ratio & dividend yield ratio charts. Sensex pe ratio can tell you the valuation of the market (overvalued, undervalued or rightly valued). Price to earnings(p/e) ratio= price/earnings. And their most recent earnings per share is rs 134. The ratio implies the amount an investor is willing to pay to earn one rupee in earnings (profit). View and download daily, weekly or monthly data to help your investment decisions. Going forward we will be using the same cape data as above (figure 3a, dark blue), but only from 1950 onwards. Therefore, if the pe ratio for sensex stands at 28, investors are willing to pay rs 28 for one. Use nifty pe to compare current valuation of nifty 50 with historic nifty pe, pb & div yield values

The ratio implies the amount an investor is willing to pay to earn one rupee in earnings (profit). The sensex pe ratio is, therefore, is the collective ratio of price per share to the earnings (of the 30 companies in sensex) per share. S&p bse sensex heat map a great tool to track s&p bse sensex stocks. See the ratios of all the stocks in top 100 sector bse If you have ever invested in equities than you might be familiar with the term sensex pe ratio (price earning ratio).

In simple terms it is used to understand the value of the share market.

Sensex pe ratio, pb ratio, dividend yield; View and download daily, weekly or monthly data to help your investment decisions. If p/e is 15, it means nifty is 15 times its earnings. In simple terms it is used to understand the value of the share market. The sensex pe ratio is updated daily. After you have understood the what is pe ratio and how to interpret pe ratio, it's time for us to share the pe ratio of sensex with readers. Similarly, eps is the ratio of the aggregate earnings of all the 30 stocks comprising the index to their total outstanding shares. Nifty pe ratio, pb ratio & dividend yield ratio charts. It is the most fundamental thing that tells the investor the valuation of the market. Going forward we will be using the same cape data as above (figure 3a, dark blue), but only from 1950 onwards. Nifty is considered to be in oversold range when nifty pe value is below 14 and it's considered to be in overvalued range when nifty pe is near or above 22. But look at the bse sensex and nse nifty. Sensex pe ratio can tell you the valuation of the market (overvalued, undervalued or rightly valued).

The sensex p/e is the ratio of price of the index to its eps. Therefore, if the pe ratio for sensex stands at 28, investors are willing to pay rs 28 for one. And their most recent earnings per share is rs 134. S&p bse sensex today is widely reported in both domestic and international markets through print as well as electronic media. The table below highlights the pe ratio of sensex for the past 6 months.

The table below highlights the pe ratio of sensex for the past 6 months.

It is the most fundamental thing that tells the investor the valuation of the market. The sensex p/e is the ratio of price of the index to its eps. Using our formula gives us a pe ratio of 23.4. Going forward we will be using the same cape data as above (figure 3a, dark blue), but only from 1950 onwards. The ratio of total market cap to total net profit is the sensex pe! Sensex pe ratio can tell you the valuation of the market (overvalued, undervalued or rightly valued). See the ratios of all the stocks in top 100 sector bse As with nifty pe ratio, investors can also investigate nifty pb ratio to gauge if the market is undervalued or overvalued. Get live s&p bse sensex quotes. S&p bse sensex heat map a great tool to track s&p bse sensex stocks. During the january 2008 peak, the sensex pe was around 28 times. Similarly, eps is the ratio of the aggregate earnings of all the 30 stocks comprising the index to their total outstanding shares. View top bse stocks based on their price earning ratios in top 100 sector.

Komentar

Posting Komentar